GOLD NEWS

GOLD NEWS

THE GOLD RESERVE ACT 1933- 1934

9. REASONS GOLD WILL SOON REPLACE TREASURIES AS THE ULTIMATE STORE-OF-VALUE ASSET

(Excerpt from Nick Giambruno via InternationalMan.com)

It’s not optimal to simply hold fiat currency, so people put their money into other assets, primarily bonds and stocks.

There is no guarantee bonds and stocks will keep up with inflation. Even if they do, they’ll be subject to capital gains tax.

50 years ago, the market cap of all the gold in the world was roughly equal to the market cap of all the stocks in the world. Today, the market cap of gold is about 10% of the world’s equities.

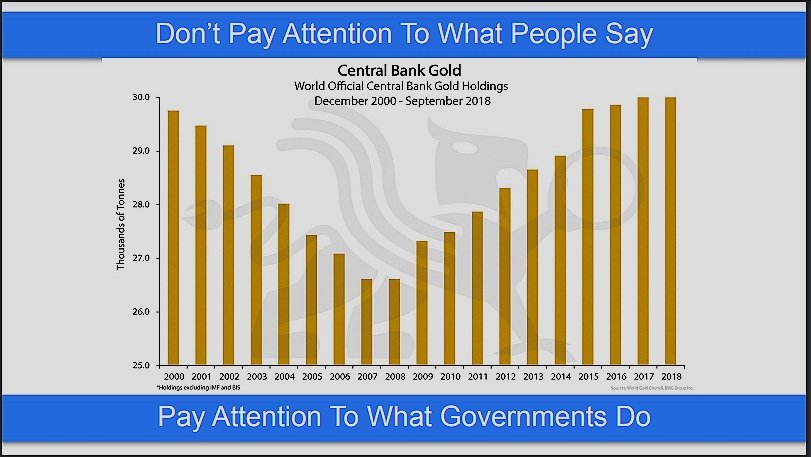

The year 2022 was the worst year for Treasuries in American history. This means a lot of the capital in bonds will be looking for a new home the functions as a better store of value. US Treasuries saw the highest central bank gold buying spree in over 55 years.

Gold has been mankind’s most enduring store-of-value asset because of its unique characteristics.

Gold is durable, divisible, consistent, convenient, scares and most importantly, the “hardest” of all physical commodities.

GOLD NEWS

GOLD NEWS

GOLD NEWS

GOLD NEWS

GOLD NEWS

GOLD NEWS

GOLD - MAKE SAVING GREAT AGAIN

GOLD - MAKE SAVING GREAT AGAIN

#1 The US Government can’t repay its debt. Default is inevitable.

#2 It will not be an explicit default.

#3 The debt will continue to grow at an accelerating pace.

#4 Foreigners are not buying as many Treasuries.

#5 The US Government cannot allow interest rates to rise much further.

#6 The Federal Reserve is the only big buyer of Treasuries stepping up, which means currency debasement.

#7 The US Government will use financial repression to debase the currency in a controlled fashion, though it could spiral out of control.

#8 Treasuries will no longer be the “go-to” store-of-value asset as people look for alternatives.

#9 Gold is the top store-of-value alternative to Treasuries. As demand for Treasuries falls, demand for gold will soar.

GOLD NEWS

GOLD NEWS

GOLD NEWS

GOLD NEWS

GOLD NEWS

GOLD NEWS

THE GOLD RESEREVE ACT 1933 -1934

On January 30, 1934, the United States Gold Reserve Act required that all gold and gold certificates held by the Federal Reserve be surrendered and vested in the sole title of the United States Department of Treasury. This Act also prohibited the Treasury and financial institutions from redeeming dollar bills for gold. A year earlier, in 1933, Executive Order 6102 had made it a criminal offense for U.S. citizens to own or trade gold anywhere in the world, with some exceptions for jewelry and collector’s coins. It wasn’t until 1975, Americans could again freely own and trade gold.